- PE 150

- Posts

- The $73B Opportunity In Mobile Phone Insurance

The $73B Opportunity In Mobile Phone Insurance

Increasing Mobile Phone costs and thefts are diving mobile phone insurance adoption with billions to capture.

In this article

Market Size

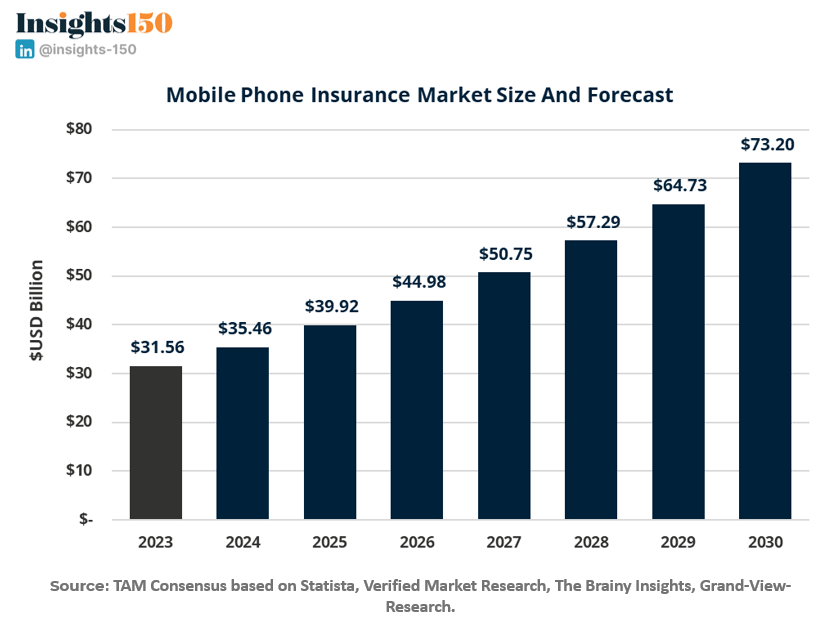

The market size for mobile phone insurance was valued at $31.56 billion in 2023, and is expected to reach $73.2 billion by 2030. It’s growing at a CAGR of ~12.77%, mostly driven by the increasing number of mobile phones, rising costs of insurance and the trend of growing theft across different geographies.

Market Drivers

Growing Smartphone Penetration: Increased smartphone adoption globally, especially in emerging markets, drives the demand for mobile insurance as more people own expensive devices.

Rising Incidence of Phone Theft and Damage: The high rate of mobile theft, accidental damage, and loss has made users more inclined to insure their devices to protect themselves from unexpected repair or replacement costs.

Cost of Smartphone Repairs: High repair costs for advanced smartphones, especially models with premium features like glass bodies, foldable screens, and high-end cameras, make mobile insurance an attractive option for users.

Growing Consumer Awareness: Increasing consumer awareness about the benefits of mobile insurance, including protection against theft, accidental damage, and loss, has spurred market demand.

Rise in Premium Smartphone Sales: The increasing sales of high-end smartphones like iPhones, Samsung Galaxy, and other premium devices lead to higher demand for mobile insurance as these are costlier to repair or replace.

Bundling of Insurance with Mobile Phones: Telecom operators and mobile retailers often bundle mobile insurance with the sale of new smartphones, which increases penetration and drives the market growth.

Emergence of Digital Insurance Platforms: The availability of digital and app-based insurance solutions makes purchasing, claiming, and managing mobile insurance more convenient, attracting tech-savvy users.

Increase in Mobile Usage for Financial Transactions: As mobile phones become central to digital payments, banking, and other financial activities, the need to protect these devices becomes more critical, further encouraging insurance adoption.

Rise in Subscription-based Services: The increasing popularity of subscription-based services for smartphones, including extended warranties, maintenance plans, and insurance, has fueled consistent growth in the mobile insurance market.

Geographical Analysis

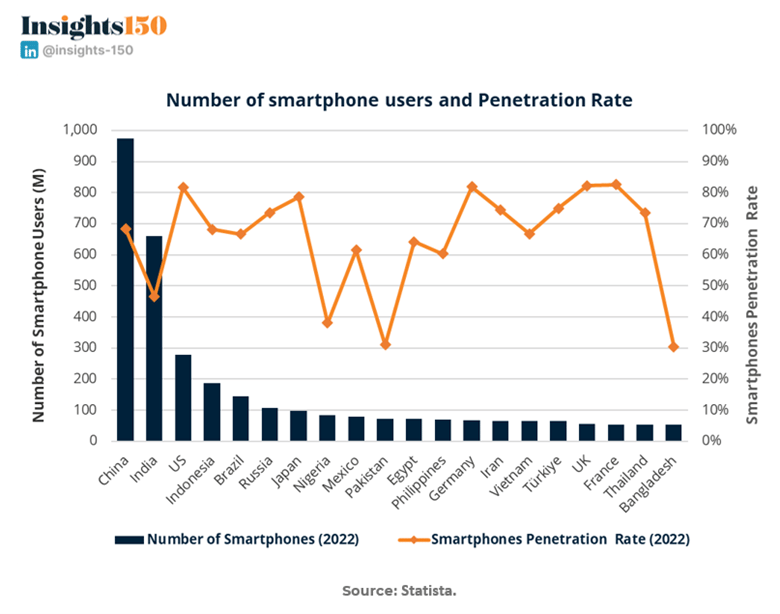

Countries with more smartphones

The country with more smartphones in the world is China, accounting with an estimated number of almost 1 billion of devices (974.69 million in 2022), mostly pushed by its large population. In the Top Five, with China there is India with 659 million of smartphones, United States with 279.14 million, Indonesia with 187.7 million and Brazil with 143.43 million (all values for 2022).

Smartphone Penetration

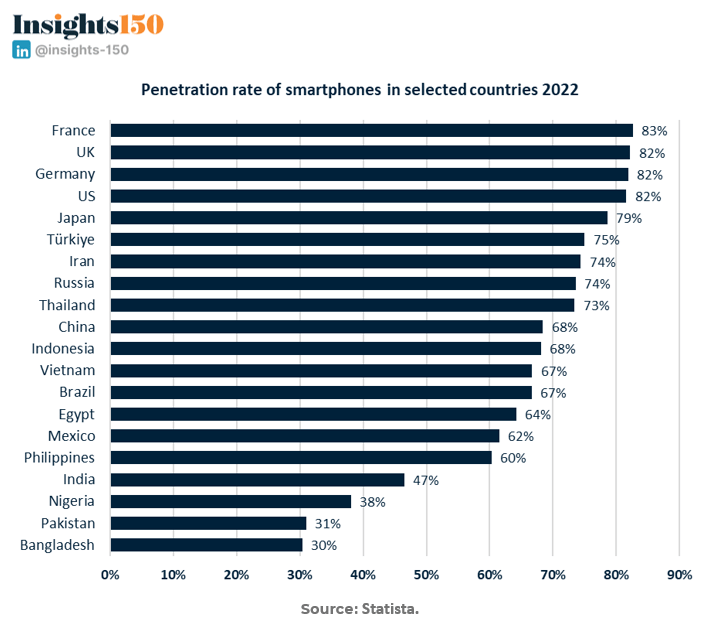

According to Statista, France ranks highest in smartphone penetration with 83%, followed by the United Kingdom, Germany, and the United States, each at 82%.

The smartphone penetration rate is a crucial factor for the mobile phone insurance market because it directly impacts the potential customer base. As the number of smartphone users increases, so does the need for protecting these devices, particularly with the rising costs of high-end smartphones and repairs.

Key reasons why penetration rate is important for the mobile phone insurance market:

Larger Customer Base: A higher smartphone penetration rate means more people own smartphones, creating a larger pool of potential customers for mobile insurance providers.

Increased Device Vulnerability: As more people rely on their smartphones for daily activities such as communication, banking, and entertainment, the risk of damage, theft, or loss increases, driving demand for insurance products to protect these valuable devices.

Higher Adoption of Premium Devices: Regions with higher penetration rates often see greater use of premium smartphones, which are more expensive to repair or replace. This makes mobile insurance more attractive, as customers seek protection from costly repairs.

Market Saturation & Competition: In countries with high smartphone penetration, mobile insurance providers face greater competition, encouraging them to offer innovative products, competitive pricing, and better services to attract customers.

Bundling Opportunities: With more smartphones in use, mobile retailers and telecom providers can bundle insurance products with new device purchases, further driving market growth.

In short, a higher smartphone penetration rate means more people are in need of protection, making it a vital driver for the growth and expansion of the mobile phone insurance market.

Smartphone Adoption Index

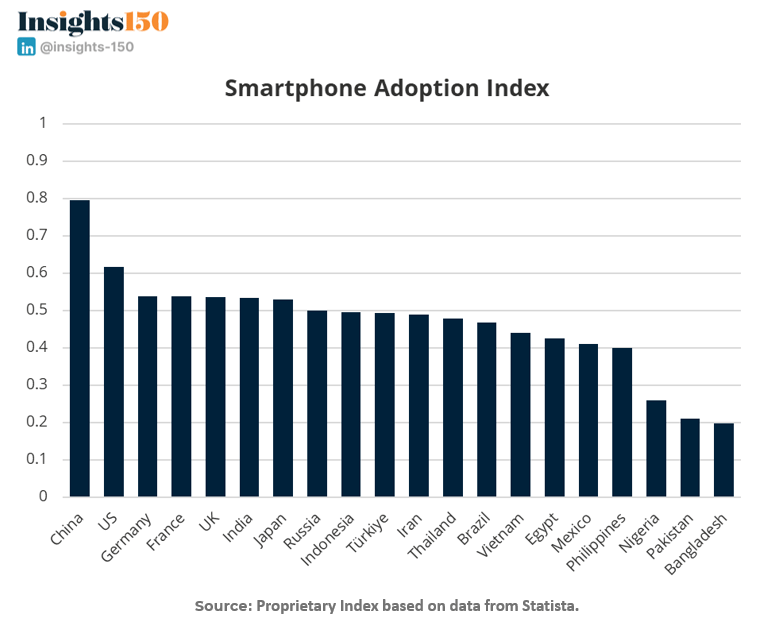

The Smartphone Adoption Index is a composite measure that evaluates the uptake of smartphones across countries by combining two key factors: Smartphone Penetration Rate (weighted at 65%) and the Normalized Number of Smartphone Users (weighted at 35%). This index offers a comprehensive view of smartphone adoption by considering both the percentage of a country’s population using smartphones and the absolute number of users.

According to the latest data, leading countries in the Smartphone Adoption Index include China, the US, Germany, France, and the UK. These nations showcase strong penetration rates and large user bases, positioning them as top markets for smartphone usage.

This high level of smartphone adoption is a key driver for the growing demand for mobile phone insurance, as more users seek to protect their valuable devices from risks such as theft, loss, and damage.

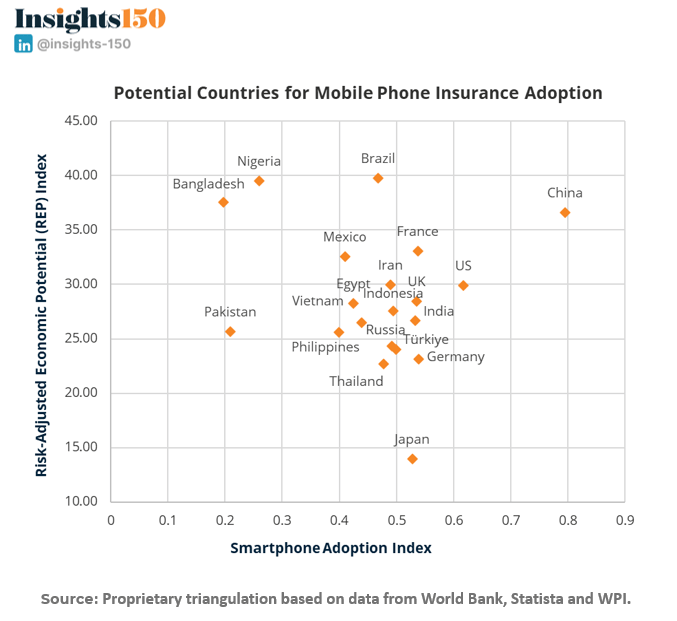

Potential Countries for Mobile Phone Insurance Adoption

In addition to smartphone adoption, mobile phone insurance requires a degree of demand inelasticity to achieve deeper market penetration, as it is a B2C service that may rank lower on consumers' priority lists. Two key factors that drive this inelasticity are purchasing power and crime rates, particularly theft, which influence consumers’ willingness to pay insurance premiums to protect their devices.

The first factor, purchasing power, reflects the budgetary constraints of consumers, while the second factor, crime rates and theft, directly increases the perceived value of insurance. As mobile phones and other valuable goods become more susceptible to theft, the demand for insurance rises as a means of protection.

To quantify the market potential, we developed the Risk-Adjusted Economic Potential (REP) Index. This index balances two proxies: "Normalized GDP per Capita, Purchasing Power Parity (Current International $)" as a measure of purchasing power, and the "Crime Index" as a measure of theft risk. We assigned a weight of 40% to normalized GDP per capita, recognizing that purchasing power plays a significant role in the final purchasing decision, and 60% to the crime index, as the threat of theft is often the primary motivator for insurance coverage consideration.

By combining the two indexes we developed—the Smartphone Adoption Index and the Risk-Adjusted Economic Potential (REP) Index—through intersection analysis, we identified the most promising geographic targets for mobile phone insurance penetration.

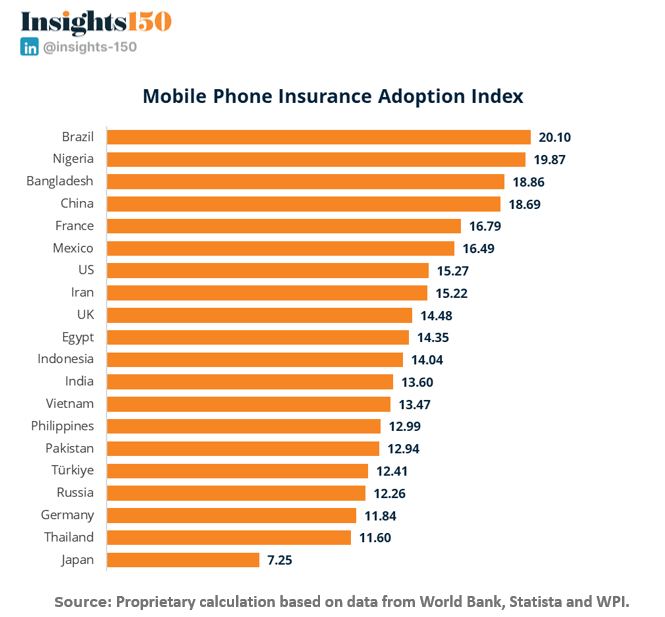

The result is the Mobile Phone Insurance Adoption Index, which gives equal weight (50% each) to both the Smartphone Adoption Index and the REP Index. This new index highlights the most attractive markets for mobile phone insurance.

Notably, Brazil ranks as the top country for mobile phone insurance adoption. This is due to its large number of mobile devices and a high Risk-Adjusted Economic Potential, driven by its status as a middle-income country with elevated crime and theft rates.

Pricing Driver: Rising Mobile Phone Prices

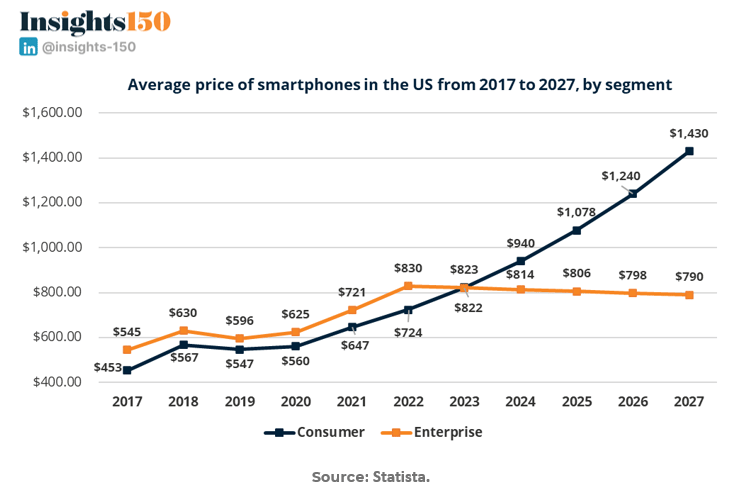

The average price of smartphones in the U.S. has shown a significant upward trend from 2017 to 2027, with the consumer segment experiencing the most notable increase. In 2017, the average price for consumer smartphones was $453.36, rising steadily to $823.00 in 2023 and projected to reach $1,430.00 by 2027, reflecting a Compound Annual Growth Rate (CAGR) of 14.81% between 2023 and 2027.

This surge is attributed to advancements in technology and increased demand for premium devices. On the enterprise side, the average price started at $545.25 in 2017, peaking at $830.00 in 2022 before declining slightly to $790.00 by 2027, indicating a more stable pricing pattern. The sharp rise in consumer smartphone prices highlights a growing market opportunity for mobile insurance, as higher device costs drive the need for protective services to mitigate financial risks associated with device damage or loss.

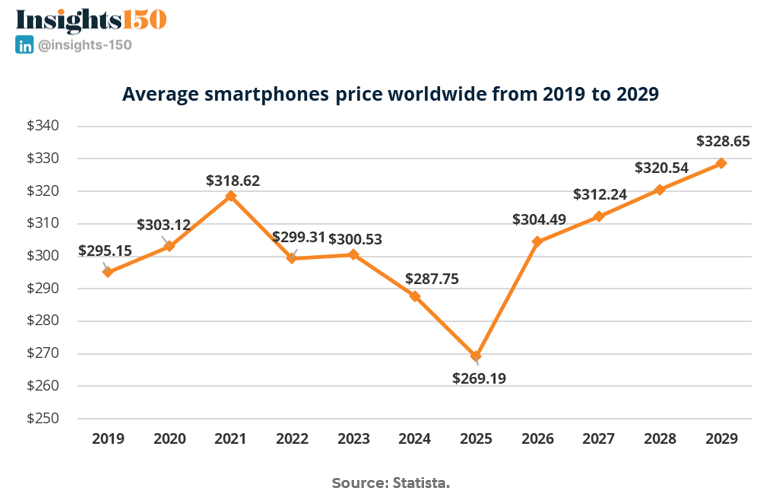

Between 2019 and 2029, the global average smartphone price has fluctuated, reflecting shifts in demand and technology. Despite this, prices are projected to gradually rise, reaching $328.65 by 2029. This trend indicates a move towards affordability, with premium devices stabilizing the average. For mobile insurance providers, these pricing variations offer opportunities to tailor coverage plans for regional markets and evolving device costs.

Private Equity’s Opportunity

Private equity sponsors have a significant opportunity in the mobile phone insurance sector, driven by rising smartphone prices, increasing device vulnerability, and growing consumer awareness of mobile protection. The mobile phone insurance market, valued at $31.56 billion in 2023, is expected to grow to $73.2 billion by 2030 at a CAGR of 12.77%, largely fueled by increasing smartphone penetration and the rising costs associated with repairing and replacing high-end devices.

This presents an attractive investment opportunity for private equity sponsors, particularly in insurtech platforms that can provide digital insurance solutions to meet the evolving needs of a tech-savvy consumer base. The emergence of digital and app-based platforms for purchasing and managing mobile insurance is driving convenience, boosting adoption rates, and offering scalable business models. Furthermore, with the global fluctuations in smartphone prices and the increasing demand for premium smartphones, particularly in high-penetration regions like the U.S. and China, insurers can benefit from customized coverage plans and innovative subscription-based models.

Private equity investment can accelerate growth in this space by leveraging technology to improve customer experience, streamline claims processes, and drive innovation in product offerings. Additionally, bundling mobile insurance with smartphone purchases or telecom services creates cross-selling opportunities that can expand market penetration and maximize returns.

Sources & References

Grand View Research. (2023). Mobile Phone Insurance Market Size, Share & Trends Analysis. https://www.grandviewresearch.com/industry-analysis/mobile-phone-insurance-market

Statista (2024). Average price of smartphones in the United States from 2013 to 2027, by segment. https://www.statista.com/statistics/619830/smartphone-average-price-in-the-us/

Statista (2022). Number of smartphone users by leading countries in 2022. https://www.statista.com/statistics/748053/worldwide-top-countries-smartphone-users/

Statista (2022). Penetration rate of smartphones in selected countries 2022. https://www.statista.com/statistics/539395/smartphone-penetration-worldwide-by-country/

Statista (2024). Size of the global mobile phone insurance market in 2022, with forecasts from 2023 to 2030. https://www.statista.com/statistics/1404304/global-mobile-phone-insurance-market-size/

The Brainy Insights. (2023). Mobile Phone Insurance Market Size by Coverage. https://www.thebrainyinsights.com/report/mobile-phone-insurance-market-13670

Verified Market Research. (2024). Mobile Phone Insurance Market Size And Forecast. https://www.verifiedmarketresearch.com/product/global-mobile-insurance-market-size-and-forecast/

World Bank. (2024). GDP per capita, PPP (current international $). https://data.worldbank.org/indicator/NY.GDP.PCAP.PP.CD?end=2023&start=1990&view=chart

World Population Review. (2024). Crime Rate by Country 2024. https://worldpopulationreview.com/country-rankings/crime-rate-by-country